Kering and the Fall of Gucci: A Luxury Empire Under Pressure

Introduction

Kering is a luxury conglomerate1 whose profits are highly concentrated in Gucci, Saint Laurent and Bottega Veneta, three iconic brands.

For years, it stood as one of the pillars of global luxury, but the group is now facing a worrying turning point, marked by a slowdown in both growth and profitability…

To understand the scale of the problem, let’s look at the numbers.

Significant decline in first-half results

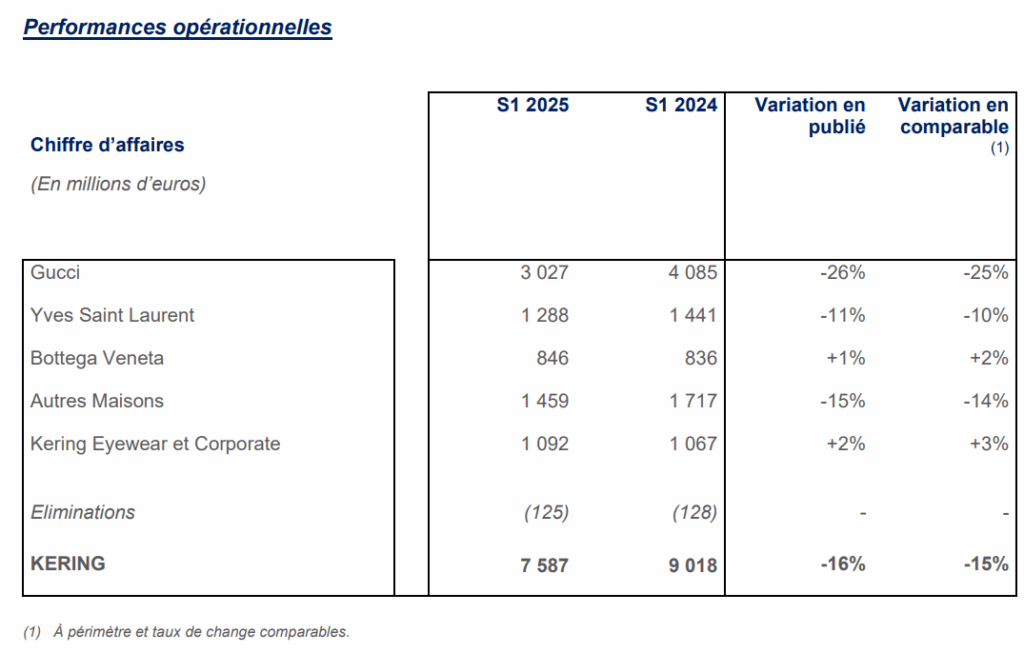

Analys of semestrial revenu (29.07.2025):

For the first half of 2025, Kering reported revenue of €7.587bn (-16% YoY / -15% like-for-like) meaning that only 15% of that decline comes from pure operational performance (organic) and the remaining 1% difference is due to external factors like currency effects or store openings, closures, acquisitions, divestitures. 1H25 revenue

The operating income (EBIT) stood at €969m, which are what Kering earned from its core business operations, after paying all operating costs (salaries, rent, marketing, production…) but before paying interest and taxes. It reflects the real profitability of Kering’s operation.Operating income (EBIT)

The group net income, which represents the profit that belongs to the shareholders of the parent company (Kering S.A) came in at €474m.

However, that doesn’t mean that all of this will be distributed to shareholders, because Kering’s board decides how much of that profit will be paid as dividends and how much will be kept to be reinvested. Net income Group share

The operating margin dropped to 12,8%, which is quite low compared to its past performance (1H2024: 17,5% and 1H2023: 27%), meaning a decline in profitability. Operating margin Kering2023

In the luxury industry, operating margins are usually much higher (often between 20 and 35% for strong brands like LVMH, Hermès or even Gucci in good years). CompagniesMarketCap

Cash flow weakness and real estate dependance

Kering reported a robust operating free cash flow of €2.4bn in the first half semester.

But out of those €2.4bn, €1.3bn came from R.E deals (selling buildings, offices), showing more than half of that CF didn’t come from normal business operations but from real estate transactions.

Kering’s ability to generate cash from its core business (luxury) is in fact weaker, at €1.1bn, that’s a warning signal for investors and analysts, there’s a deterioration in Kering’s operational performance. Operating free cash flow

François-Henri Pinault (Chairman and Chief Executive Officer) is aware of this: “Si les résultats publiés restent encore bien en deçà de notre potentiel, nous sommes convaincus que les efforts déployés depuis deux ans ont permis de poser des bases solides pour les prochaines étapes du développement de Kering.“

Spectacular asset disposals to maintain balance

In 2025, Kering sold 60% of its Parisian real estate portfolio to Aridan2 for €837 million, including some of the group’s most prestigious assets: the Hôtel de Nocé (place Vendôme) and two buildings on Avenue Montaigne. Kering

In January, the company also sold its “The Mall Luxury Outlets” business, including two luxury outlet villages in Italy, to Simon Property Group (US) for €350 million. FashionNetwork

The remaining €100 million came from smaller transactions.

Update (12.16.2025): Kering has announced the sale of 60% of its Fifth Avenue New York property to Ardian for €766 million, confirming the group’s continued cash generation through asset sales.

These sales generated immediate liquidity but raise a question:

Is Kering managing its portfolio strategically, or selling its jewels to finance short-term stability?

A strategic Response to Financial Pressure

The reason behind these disposals becomes clearer when looking at Kering’s market value.

In just four years, the group’s market capitalization has fallen from €97 billion to €40 billion, a loss of more than half its value!

The 1H 2025 only confirmed this downward trajectory:

- Revenue down 16%

- Operating income down 39%

- Net profit halved

- EBITDA down 23%

All major indicators are declining simultaneously.

The Real Reason of this Kering’s decline

The real reason behind Kering’s downturn lies in the difficulties face by its main profit driver: Gucci. L’Essentiel de l’Eco

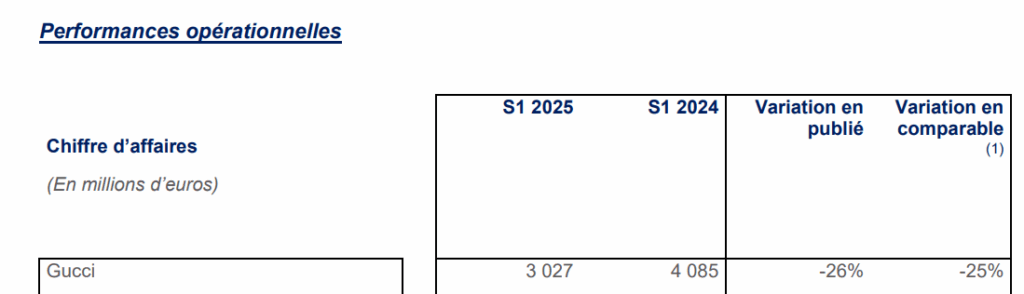

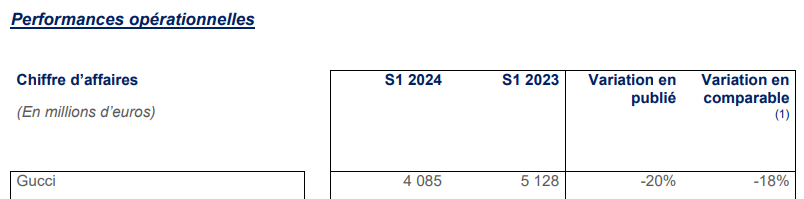

The group’s revenue from its Gucci division has dropped sharply.

Year-on-year,. that represents a 25,9% decline.

But this decline isn’t new.

Looking back at 1H24, the same trend was already visible, with a 20% drop in group revenue.

By contrast, in 1H23, Gucci’s sales were down only 1% compared to 2022 and in 1H22, revenue was actually up 15% compared to 2021. Kering24, Kering22

A Brand in Decline

Key figures per brand show that in 2024, Gucci generated €7.65 billion, representing 44.5% of Kering’s total revenue of €17.194 billion.

However, this also reflects a -23% drop in Gucci’s sales compared with 2023. Kering

Historically, the contrast is stark.

In 2022, Kering’s total revenue was €20.351 billion, with €10.487 billion coming from Gucci (51.5% of the group’s total). Kering

In 2021, Gucci accounted for 55.1% of total sales. Kering

Why did Gucci’s Sales Collapse?

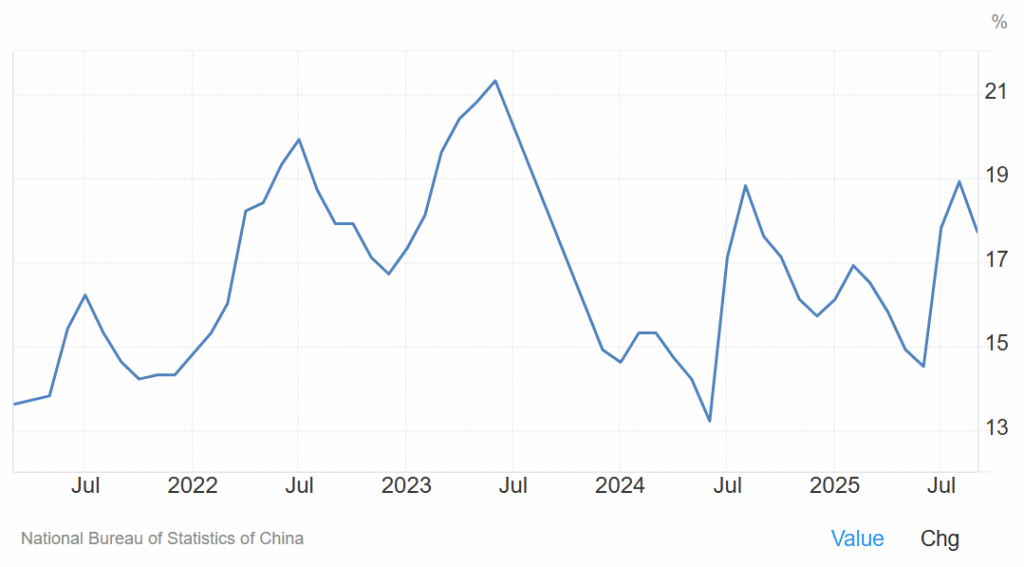

- Too dependent on China:

Gucci relied heavily on young Chinese buyers, consumers who used to see Gucci as a way to enter the world of luxury. But since 2022, this audience has been spending less.

Wealthier consumers have shifted toward more discreet labels such as Hermès and Dior, associated with “quiet luxury3”.

Kering’s geographical revenue breakdown shows that in 2025, 8% of total sales came from Japan and 30% from the Asia-Pacific region. Kering

While Asia remains a key market, several factors such as the property crisis, rising unemployment, and sociopolitical pressures have weakened Chinese consumer confidence.

Since September 2021, property developer Evergrande has been unable to repay its debts.

Once accounting for 2% of China’s GDP, the company was the most indebted real estate developer in the world, owing over $300 billion (€257 billion) to banks and bondholders when a Hong Kong court ordered its liquidation in January 2024. Euronews

The consequences have been devastating: thousands of construction projects halted, partner companies bankrupt, and unemployment surging.

Given that real estate represented around 26% of China’s GDP in 2021, the sector’s collapse has affected the entire economy, leading to a shortage of jobs for young graduates. IbisWorld

2. Brand Fatigue and Creative Transition

The eccentric and colorful style of Alessandro Michele4 , which had more than doubled Gucci’s sales between 2015 and 2019, stopped working because consumers simply got tired of it. In November 2022, Kering asked him to step down.

To reposition Gucci, the group appointed Sabato De Sarno5 as the new creative director, with a mission to embrace the “quiet luxury” trend followed by Hermès, Loro Piana, and Dior.

Unfortunately, the expected rebound never came, sales continued to decline and the group decided to part ways with him, “not a huge surprise given Gucci’s underperformance compared to peers.” analysts at RBC6 noted.

In July 2025, Demna Gvasalia took over as creative director.

Known for setting global fashion trends at Balenciaga, particularly with luxury streetwear, he now faces the challenge of redefining Gucci’s identity and reviving its desirability.

Time will tell whether he can bring the same disruptive energy to Gucci.

In July 2025, Demna Gvasalia took over as creative director.

Known for setting global fashion trends at Balenciaga, particularly with luxury streetwear, he now faces the challenge of redefining Gucci’s identity and reviving its desirability.

Time will tell whether he can bring the same disruptive energy to Gucci.

Financial Pressures Mounting

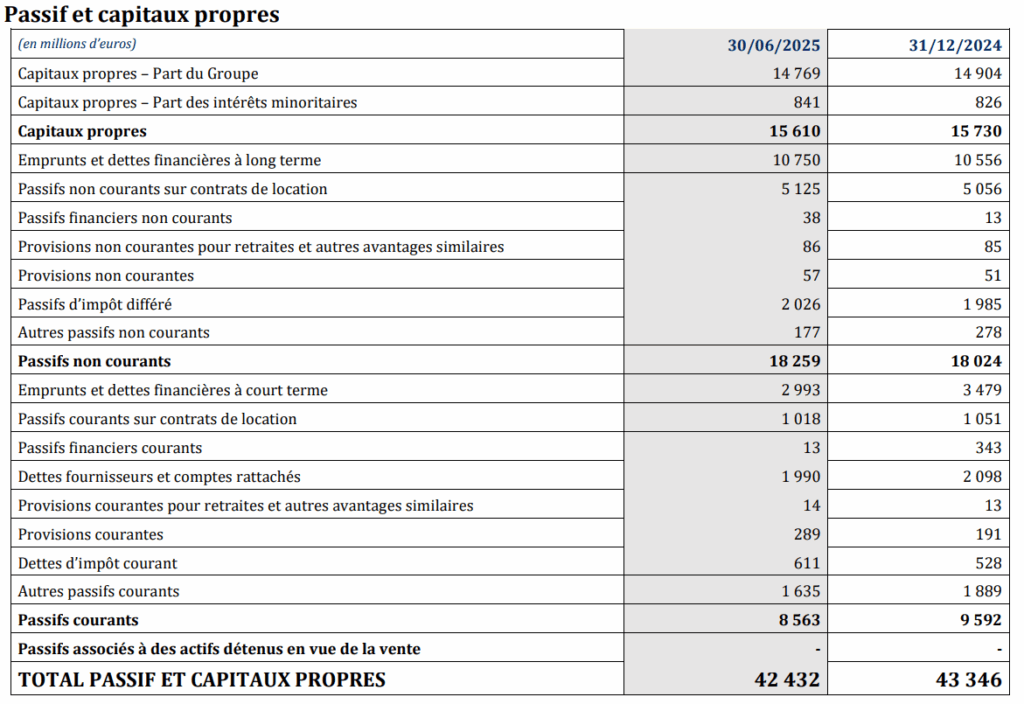

As of June 30, 2025, Kering reported a net debt of €9.5 billion, to which must be added €6 billion in long-term lease liabilities ( €5.125 million in non-current lease liabilities and €1,018 million in other non-current liabilities), which represent the rents to be paid over the long term for its stores and offices. Kering

A Risky but Necessary Strategic Turning Point for Kering

The group therefore needs to implement a solution to reduce its debt, which requires major strategic decisions, such as the sale of its beauty division to L’Oréal on October 19, 2025, for an amount of €4 billion.

In addition, the Board of Directors of Kering, chaired by François-Henri Pinault, approved the appointment of Luca de Meo as the new Chief Executive Officer on June 16, 2025.

The former CEO decided to step down from operational management in order to strengthen the group’s governance and focus on its long-term strategy.

Will all these decisions allow Gucci to recover?

Will the real estate crisis in China ease, thereby reviving demand among young consumers currently facing unemployment?

It is a risky bet that the group’s management has chosen to make, changing once again Gucci’s Creative Director and CEO, but the sale of the beauty division to L’Oréal could help restore the brand’s momentum.

To be continued…